The halal food market has been

experiencing significant growth in recent years. Halal food refers to food that

is prepared and consumed according to Islamic dietary laws, which prohibit the

consumption of pork and alcohol. The market for halal food is driven by the

growing Muslim population, which is projected to reach 2.2 billion by 2030, as

well as the increasing awareness and demand for halal food among non-Muslim

consumers.

According to a report by Fortune

Business Insights, the global halal food and beverages market was valued at USD

1.96 trillion in 2020 and is expected to reach USD 3.27 trillion by 2028,

growing at a CAGR of 6.56% during the forecast period. The report also

highlights the key factors driving the growth of the halal food market, including

the increasing demand for halal-certified products, the rise of e-commerce and

online food delivery platforms, and the growing trend of vegan and vegetarian

halal food. The report also identifies the major players in the market,

including Nestle, Cargill, and Al Islami Foods.

The halal food market is not limited

to food products alone, but also includes halal-certified cosmetics,

pharmaceuticals, and financial services. The market is expected to continue

growing in the coming years, driven by the increasing Muslim population and the

growing demand for halal products among non-Muslim consumers.

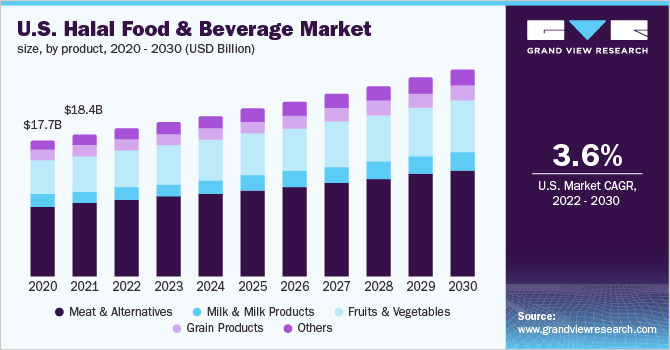

Global Overview of Halal Food Market

|

| Image Source:grandviewresearch |

According to a report by Statista,

the global Muslim population is expected to reach 2.2 billion by 2030, which

will further boost the demand for halal food products. The report also states

that the global halal food market is expected to grow at a CAGR of 6.3% from

2021 to 2026.

The halal food market is not limited

to Muslim-majority countries but has also gained popularity in non-Muslim

countries, such as the United States, Canada, and the United Kingdom. The

demand for halal food products is not only driven by the Muslim population but

also by non-Muslims who perceive halal food as healthy and safe to consume.

The halal food market is broadly

classified into two categories: halal meat products and halal non-meat products.

Halal meat products include beef, lamb, chicken, and other meat products that

are slaughtered according to Islamic dietary laws. Halal non-meat products

include dairy products, confectionery, snacks, and beverages that do not

contain any haram (forbidden) ingredients.

The halal food market is dominated

by Asia-Pacific, followed by the Middle East and Africa. The Asia-Pacific

region is the largest market for halal food products, accounting for over 60%

of the global halal food market share. The Middle East and Africa are the

second-largest market for halal food products, accounting for over 20% of the

global halal food market share.

In conclusion, the global halal food

market is a rapidly growing industry that caters to the dietary requirements of

Muslims worldwide. The increasing demand for halal food products is driven by

an increase in consumer demand and a rising Muslim population globally. The

halal food market is not limited to Muslim-majority countries but has also

gained popularity in non-Muslim countries. The market is broadly classified

into two categories: halal meat products and halal non-meat products, and is

dominated by Asia-Pacific, followed by the Middle East and Africa.

Current Size of the Halal Food Market

The global halal food market has been growing steadily over the past few

years. According to a report by IMARC Group, the market size reached US$

2,221.3 Billion in 2022. Looking forward, the market is expected to reach US$

4,177.3 Billion by 2028, exhibiting a growth rate (CAGR) of 10.8% during

2023-2028.

The halal food market is driven by an increase in consumer demand, followed

by a rising Muslim population globally. The Global Halal Food Market Report

2021-24 estimates global halal food trade (imports to OIC member countries) to

be valued at US$ 129 billion in 2019 and is projected to grow at 1.7% CAGR,

reaching US$ 140 billion by 2024.

The market share of halal food is also increasing. According to Statista,

the global halal market size was valued at 2 trillion USD in 2021 and is

expected to reach 3.2 trillion USD by 2026. In 2021, the market share of halal

food and beverages was estimated to be 18.8%, with the highest share in the

Asia-Pacific region.

Halal food claimed product launches increased globally by 19% from 2018 to

2020, from 16,936 products to 20,482. 63% of these are from Asia, followed by

the Middle-East and Africa (14% and 10%, respectively). For the eight

consecutive year, Malaysia continues to maintain its top position in the

overall Global Islamic Economy Indicator.

Overall, the halal food market is expected to continue to grow in the coming

years, driven by an increase in consumer demand and a rising Muslim population

globally.

Key Players in the Halal Food Market

The global halal food market is highly competitive, with many players

operating in the market. Some of the key players in the industry include Al

Islami Foods, Al-Falah Frozen Foods, BRF, DagangHalal Sdn. Bhd., Midamar Halal,

Prima Agri-Products, QL Foods Sdn. Bhd., Saffron Road, Nestle, and Kellogg's.

Al Islami Foods is a UAE-based company that specializes in halal food

products, including frozen meat, poultry, and seafood. The company has a strong

presence in the Middle East and North Africa (MENA) region, as well as in Asia

and Europe.

Al-Falah Frozen Foods is a Pakistan-based company that produces halal meat products, including beef, mutton, and chicken. The company has a global presence and exports its products to more than 20 countries.

DagangHalal Sdn. Bhd. is a Malaysian company that provides halal

certification services to food manufacturers and producers. The company also

operates an online marketplace for halal products, connecting buyers and

sellers from around the world.

Midamar Halal is an American company that produces halal meat products,

including beef, lamb, and chicken. The company has a strong presence in the

United States and exports its products to more than 30 countries.

Prima Agri-Products is a Singapore-based company that produces halal meat

products, including beef, lamb, and chicken. The company has a global presence

and exports its products to more than 50 countries.

QL Foods Sdn. Bhd. is a Malaysian company that produces halal meat products,

including chicken and duck. The company has a strong presence in Southeast Asia

and exports its products to more than 20 countries.

Saffron Road is an American company that produces halal frozen meals and

snacks, including chicken nuggets, samosas, and biryani. The company has a

strong presence in the United States and is expanding into other markets.

Nestle is a Swiss company that produces a wide range of halal food products,

including baby food, dairy products, and confectionery. The company has a

global presence and operates in more than 190 countries.

Regional Analysis of the Halal Food Market

The global halal food market is expected to experience significant growth in

the forecast period of 2023-2028. The market is segmented into different

regions, including Asia Pacific, Middle East and Africa, North America, Europe,

and Latin America.

.webp) |

| Image Credit:imarcgroup |

Asia Pacific

Asia Pacific is the largest market for halal food and is expected to

continue to dominate the market in the forecast period. The region has a large

Muslim population and a growing demand for halal food products. Countries such

as Indonesia, Malaysia, and Pakistan are major contributors to the growth of

the halal food market in the region.

Middle East and Africa

The Middle East and Africa region is another significant market for halal

food. The region has a large Muslim population, and the demand for halal food

products is high. Countries such as Saudi Arabia, UAE, and Egypt are major

contributors to the growth of the halal food market in the region.

North America

North America is a growing market for halal food due to the increasing

demand for halal food products among the Muslim population in the region. The

region has a growing Muslim population, and there is a growing awareness of

halal food among non-Muslims as well.

Europe

Europe is another growing market for halal food, with a growing Muslim

population and a growing demand for halal food products. Countries such as

France, Germany, and the UK are major contributors to the growth of the halal

food market in the region.

Latin America

Latin America is a relatively small market for halal food, but it is

expected to experience significant growth in the forecast period. The region

has a growing Muslim population and a growing demand for halal food products.

Countries such as Brazil and Argentina are major contributors to the growth of

the halal food market in the region.

Overall, the halal food market is expected to experience significant growth

in the forecast period, with Asia Pacific and the Middle East and Africa being

the largest markets for halal food.

Halal Certification Process

|

| image source: Freepik |

Firstly, the manufacturer or supplier of the food product must apply for

halal certification from a recognized certification body. The certification

body will typically require the manufacturer to provide detailed information

about the ingredients used in the product, as well as information about the

manufacturing process.

Once the application has been received, the certification body will

typically conduct an audit of the manufacturing facility to ensure that all

halal requirements are being met. This may involve inspecting the manufacturing

process, reviewing ingredient lists, and checking that all equipment and

utensils used in the manufacturing process are free from contamination.

If the certification body is satisfied that the product meets all halal

requirements, it will issue a halal certificate. The certificate will typically

include information about the product, the manufacturer, and the certification

body, as well as any relevant halal logos or symbols.

It is important to note that halal certification is not a one-time process.

Manufacturers must renew their certification on a regular basis, typically

every year or two, to ensure that their products continue to meet halal

requirements.

Overall, the halal certification process is designed to ensure that food

products meet strict halal requirements and are suitable for consumption by

Muslims. While the process can be complex, it is an important step in ensuring

that halal food products are produced and marketed in a responsible and ethical

manner.

Market Trends and Growth Factors

The halal food market has been experiencing significant growth over the past

few years. According to a report by Future Market Insights, the global halal

food demand is projected to grow year-on-year (Y-o-Y) by 9.1% in 2022. The

market size reached USD 2,221.3 Billion in 2022, and it is anticipated to reach

USD 4,177.3 Billion by 2028, exhibiting a growth rate (CAGR) of 10.8% during

2023-2028.

One of the primary factors driving the growth of the halal food market is

the increasing demand for halal food among both Muslims and non-Muslims. The

Muslim population is growing at a faster rate than the global population, and

the demand for halal food is increasing accordingly. Additionally, non-Muslims

are also consuming halal food due to its perceived health benefits and ethical

considerations.

Another factor contributing to the growth of the halal food market is the

advancement in healthy technologies incorporated in the production of halal

food. Consumers are becoming more health-conscious and are looking for food

products that are free from harmful chemicals and preservatives. Halal food

manufacturers are responding to this trend by incorporating healthy

technologies in their production processes.

Strict regulations implementations are also driving the growth of the halal

food market. The halal food industry is highly regulated, and the certification

process is rigorous. This ensures that the halal food products meet strict

standards of quality and safety. The increasing implementation of regulations

is further boosting the demand for halal food products.

In conclusion, the halal food market is projected to experience significant

growth in the coming years. The increasing demand for halal food among both

Muslims and non-Muslims, advancement in healthy technologies incorporated, and

strict regulations implementations are the factors driving growth in the

market.

Challenges and Restraints in the Halal Food Market

The halal food market is not without its challenges and restraints. Despite

the growth potential, the industry faces several obstacles that could hinder

its progress. Here are some of the primary challenges and restraints in the

halal food market:

Lack of Standardization

One of the significant challenges in the halal food market is the lack of

standardization. Different countries and regions have their own halal

certification bodies and standards, which can create confusion for consumers

and manufacturers. This lack of standardization can also lead to fraud and

misrepresentation, making it difficult for consumers to trust the halal food

products they purchase.

Limited Awareness

Another challenge in the halal food market is the limited awareness among

non-Muslim consumers. While the Muslim population is growing globally,

non-Muslim consumers may not be aware of the halal food market or the benefits

of halal food. This limited awareness can limit the potential growth of the

halal food market, as it may not attract a broader consumer base.

High Certification Costs

The certification process for halal food products can be expensive, which

can be a restraint for small and medium-sized enterprises (SMEs). The high

certification costs can also lead to higher prices for halal food products,

which may deter price-sensitive consumers from purchasing them.

Limited Supply Chain

The halal food market faces a limited supply chain, which can limit the

availability of halal food products. This limited supply chain can be

attributed to several factors, including the lack of standardization, limited

awareness, and high certification costs. As a result, halal food products may

not be readily available in some regions, limiting the growth potential of the

market.

In summary, the halal food market faces several challenges and restraints,

including the lack of standardization, limited awareness, high certification

costs, and a limited supply chain. Overcoming these challenges will be crucial

for the halal food market to reach its full potential and attract a broader

consumer base.

Future Projections of the Halal Food Market

The Halal food market is expected to continue its growth trajectory in the

coming years. According to a report by IMARC Group, the market is projected to

reach US$ 4,177.3 Billion by 2028, exhibiting a growth rate (CAGR) of 10.8%

during 2023-2028. The report also highlights the key factors driving the growth

of the market, including the increasing demand for halal-certified food among

Muslim consumers, the rising Muslim population across the world, and the

growing awareness about halal food among non-Muslim consumers.

Another report by The Business Research Company predicts that the Halal food

market size will grow to $2,583.18 billion in 2027 at a CAGR of 14.5%. The

report notes that the increasing demand for halal-certified food products from

non-Muslim consumers, especially in Western countries, is expected to drive the

growth of the market in the coming years.

In addition, the Future Market Insights market analysis shows that global

halal food demand is projected to grow year-on-year (Y-o-Y) growth of 9.1% in

2022. The report states that the increasing number of halal-certified products

in the market, along with the growing number of halal-certifying agencies, is

expected to boost the growth of the market in the coming years.

Furthermore, the global Halal food market report by Expert Market Research

predicts that the market will rise at a CAGR of nearly 17% in the forecast

period of 2023-2028 to reach a value of about USD 3 trillion by 2026. The

report highlights that the increasing demand for halal food products among

non-Muslim consumers, especially in emerging economies, is expected to drive

the growth of the market in the coming years.

Overall, the Halal food market is expected to continue its growth trajectory

in the coming years, driven by the increasing demand for halal-certified food

products among Muslim and non-Muslim consumers, the rising Muslim population

across the world, and the growing awareness about halal food among non-Muslim

consumers.

Conclusion

The halal food market has been experiencing steady growth over the past few

years, and it is projected to continue growing in the coming years. The market

size is expected to reach USD 3 trillion by 2028, exhibiting a CAGR of 6.56%

during the forecast period (2021-2028) 1. The market is

driven by factors such as the increasing Muslim population, rising awareness

about halal food products, and the growing demand for convenience food

products.

The Asia Pacific region dominates the halal food market, accounting for the

largest market share. The region is expected to continue its dominance during

the forecast period. The Middle East and Africa region is also expected to

witness significant growth due to the increasing Muslim population and rising

demand for halal food products 2.

In terms of product type, the meat and alternatives segment is expected to

hold the largest market share during the forecast period. However, the processed

food and beverages segment is expected to witness the highest growth rate

during the forecast period due to the increasing demand for convenience food

products 3.

The halal food market is highly competitive, with a large number of players

operating in the market. The key players in the market include Nestle S.A.,

Kellogg Company, Al Islami Foods, and others. These players are focusing on

product innovation, expansion, and strategic partnerships to strengthen their

market position 4.

Overall, the halal food market is expected to continue growing due to the

increasing Muslim population, rising awareness about halal food products, and

the growing demand for convenience food products. The market is highly

competitive, and players are focusing on product innovation and expansion to

strengthen their market position.

Footnotes

1. https://www.fortunebusinessinsights.com/halal-food-and-beverages-market-106186

↩

2. https://www.futuremarketinsights.com/reports/halal-food-market

↩

3. https://www.imarcgroup.com/halal-food-market

↩

4. https://www.expertmarketresearch.com/reports/halal-food-market

↩

Comments

Post a Comment